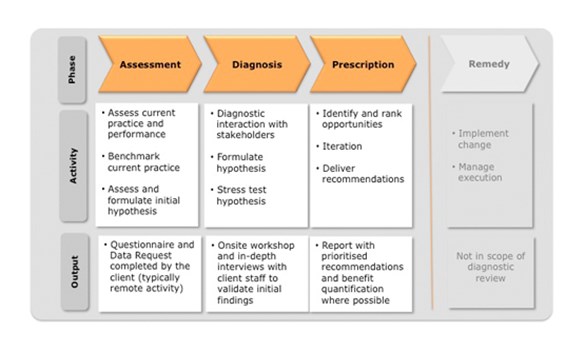

Our consultancy falls into three key areas: diagnostic investigations (typically healthchecks), advisory (bespoke consultancy) and modelling (business cases, financial/performance analysis).

Each consultancy assignment is led by a managing consultant who coordinates the work of our team of experts from across our five practice areas to ensure we exceed our clients’ expectations.

We service client projects through our multilingual teams located in Europe, AP, North America and Latin America, proving both local market knowledge and subject matter expertise.

Coupled with the expertise of our associate consultants, the Insight team has worked in most card markets in the world.

Our consultants all have experience in working in multiple markets at diverse stages of card market maturity. Many of our practitioners are multi lingual with the ability to speak with clients in their local language. This includes Spanish, French, German, Chinese, Japanese, Portuguese.

We have 5 practice areas which cover all aspects of payment card issuing and acquiring and the full range of card types - consumer/commercial or credit, debit or prepaid.

Each practice area has a practice lead who has particular strengths and expertise in these areas. In many projects we undertake there is overlap between these areas, so while we may be undertaking a Merchant Acquiring assignment, there could be strategic and financial analysis elements to the project where we leverage the expert knowledge from other practice areas.

In addition to practice specialists, we also have Subject Matter Experts who have specific skills by product or subject, eg Debit, Prepaid, Cobranding.

The card payment market is one of the most complex and fast-changing environments in the business world. It is all the more important therefore, that the financial dynamics of this industry are well understood by any organisation already in, or planning on, entering this market.

Insight Consultancy is recognised as a leader in the payment cards industry for financial analysis and modelling.

Our Practice Areas

Our practice areas cover the full payments lifecycle across issuing and acquiring. Clients work with us to address a single issue or on a programme wide basis for both strategic and tactical support.

Whether you are considering launching a new card or payment product, need help deciding on which card scheme to choose or you are looking to drive greater profitability on your existing account portfolio, we have the skills and experience to help.

- New Market Entry

- Commercial Framework

- Market Research

- NPD

- Cobranding & Partner Management

- Conversions & Flips

- Primary & Secondary Research

- Benchmarking Surveys

- Programme Development

- Programme Optimisation

- Card Marketing Strategy

- Retention strategy

- Customer Lifecycle Management

- Loyalty Marketing

- Customer Segmentation

- Data Mining and Targeting

- Campaign Management

- Credit Risk

- Fraud Strategy & Investigations

- Regulatory Compliance

- Outsourcing & Alliances (incl. RFP Management)

- Technical Platform Requirements

- Solutions Design & Definition

- Implementation Planning & Testing

- Project Management

- Operational Audits

- Financial Modelling

- Profit Optimisation Strategies

- Interchange Analysis & Modelling

- Scheme Fees Assessment

- Business Case Tools

- Profitability & Pricing Strategies

- Dashboards & MI Tools